When a brand-name drug’s patent expires, you’d expect generics to flood the market and prices to drop. But in reality, many of these drugs stay expensive for years longer than they should. Why? Because of a legal chess game played out in courtrooms, not pharmacies. Patent litigation in the generic drug market isn’t just about protecting innovation-it’s become a tool to block competition, delay savings, and keep patients paying more than they should.

The Hatch-Waxman Act: A System Designed to Balance Interests

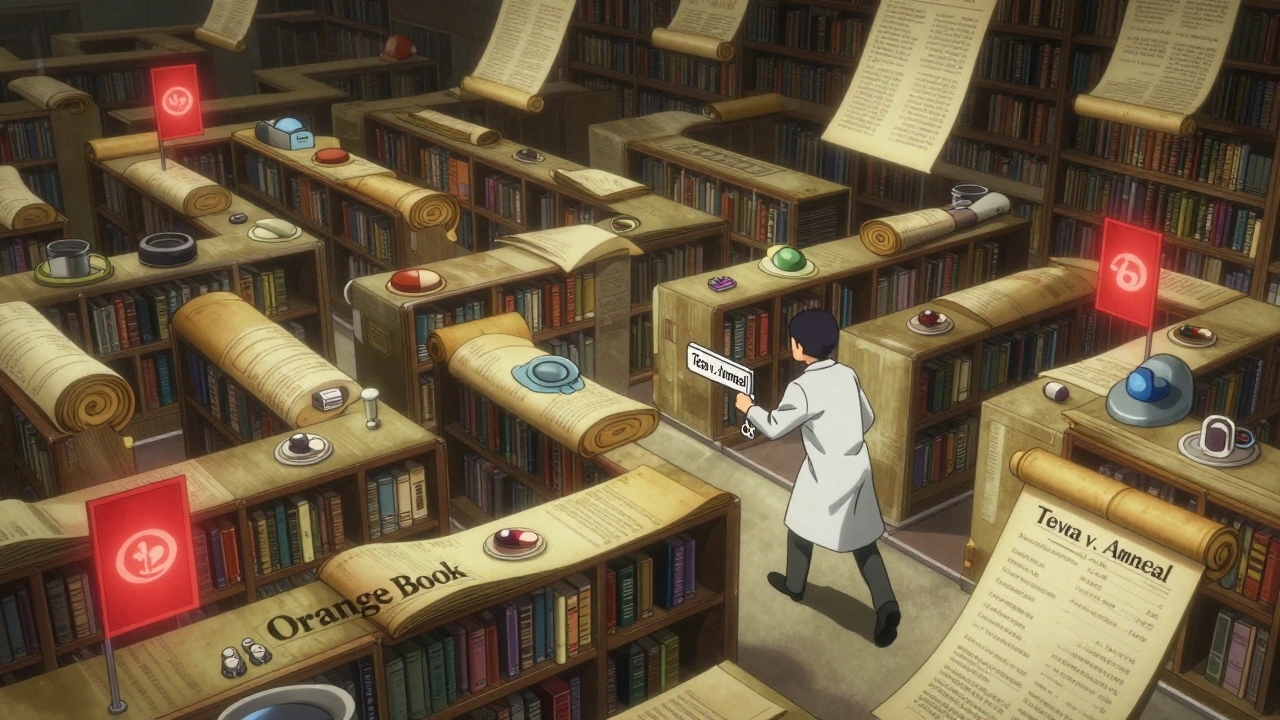

The foundation of all this legal activity is the Hatch-Waxman Act of 1984. It was meant to strike a balance: reward drug companies for inventing new medicines while making it easier for generics to enter the market after patents expire. The system gave generic manufacturers a shortcut: instead of running full clinical trials, they could file an Abbreviated New Drug Application (ANDA) proving their product is the same as the brand-name drug. But here’s the twist. If a generic company believes a patent is invalid or won’t be infringed, they can file what’s called a Paragraph IV certification. That’s a legal challenge. And when they do, the brand-name company has 45 days to sue. Once they do, the FDA can’t approve the generic for up to 30 months. That’s not a review delay-it’s a legal pause button. And it’s been used, repeatedly, to keep prices high.The Orange Book: Where Patents Are Listed-And Sometimes Abused

The FDA’s Orange Book is supposed to be a simple list: patents that cover the active ingredient, how the drug is made, or how it’s used. That’s it. But in practice, companies have stretched the rules. They list patents for things like inhaler buttons, pill coatings, or packaging designs-anything that can delay a generic. In 2025, a key ruling in Teva v. Amneal changed that. Judge Chesler ruled that patents on the dose counter in ProAir® HFA inhalers didn’t qualify because they didn’t claim the actual drug-albuterol sulfate. That decision is now being used as a template to challenge hundreds of similar listings. Skadden’s analysis suggests 15-20% of all Orange Book patents might be invalid under this standard. The FDA is finally catching up. New rules, expected in mid-2026, will require brand companies to certify under penalty of perjury that every patent they list actually meets the legal standard. That’s a big deal. Right now, there’s no real penalty for listing junk patents.Serial Litigation: The Slow-Motion Blockade

One patent expires? No problem. The brand company just files another lawsuit with a different patent. And another. And another. The Association for Accessible Medicines tracked ten cases where this happened. In one, a drug’s original patent expired in 2012-but generic versions didn’t hit the market until 2021. That’s nine years of lost savings. Patients kept paying $300 for a prescription that could’ve cost $30. This isn’t rare. It’s standard. Oncology drugs are the worst offenders. One drug, semaglutide (used in Ozempic and Wegovy), has 152 patents protecting it. That’s not innovation-it’s a legal fortress. The average number of patents per small-molecule drug has jumped from 37 in 2015 to 78 for biologics today. Each patent is a new chance to sue, delay, and distract.

Where the Lawsuits Happen: The Eastern District of Texas

Not all courts are created equal. Since 2023, the Eastern District of Texas has become the go-to venue for patent lawsuits. In 2024, 38% of all pharmaceutical patent cases were filed there. Why? Because judges there are experienced, procedures favor plaintiffs, and juries tend to side with big pharma. Compare that to the District of Delaware, which used to be the hotspot. Now it’s just 15% of cases. The shift matters. When a company knows it can file in Texas, it’s more likely to sue-even if the patent is weak. The cost of defending a lawsuit is so high that many generic companies settle just to avoid the risk.Patent Settlements: Are They Good or Bad?

Here’s where things get messy. The FTC says patent settlements between brand and generic companies are often “pay-for-delay” deals: the brand pays the generic to stay off the market. They’ve challenged over 300 improper patent listings in 2024 alone. But here’s the counterargument: IQVIA’s 2025 report found that settlements actually get generics to market faster-on average, more than five years before the patent expires. Why? Because without the option to settle, generics might never file a Paragraph IV challenge at all. The fear of losing a multi-million-dollar lawsuit is too high. John T. O’Donnell, an industry analyst, put it bluntly: “If you limit a generic manufacturer’s ability to settle, that manufacturer does not settle fewer cases-it submits fewer ANDAs.” In other words, the threat of litigation discourages entry altogether. So are settlements good or bad? It depends. Some are shady. Others are the only way a small generic company can survive.

Lynette Myles

December 5, 2025 AT 07:01This isn't about patents-it's about corporations buying judges.

Annie Grajewski

December 6, 2025 AT 08:20so like... the whole system is just a giant game of monopoly where big pharma owns all the properties and we're stuck paying rent on oxygen? lol. also why does everyone keep suing in texas? is it because the judges have free donuts and no one can find the courthouse?

Lucy Kavanagh

December 7, 2025 AT 21:13you ever notice how every time a new drug gets approved, 30 patents pop up overnight? it’s not innovation-it’s legal spam. and the FDA? they’re just sitting there like a librarian who doesn’t want to get fired for being too strict. i swear, this is how dystopias start: with paperwork.

Jimmy Jude

December 9, 2025 AT 17:16let me get this straight-patients are dying because lawyers figured out how to turn medicine into a legal loophole casino? and the people who profit? they’re sipping single-origin espresso in their penthouses while grandma chooses between insulin and groceries. this isn’t capitalism. this is feudalism with better PR.

Mark Ziegenbein

December 11, 2025 AT 14:54the entire pharmaceutical patent regime is a monument to institutional decay where the legal system has been weaponized into a tax on human survival. the Hatch-Waxman Act was a noble compromise but it was never meant to be exploited as a multi-decade delay mechanism disguised as intellectual property protection. the fact that we now have drugs with over 150 patents is not a sign of innovation-it’s a sign of moral bankruptcy masked as corporate strategy. the PTAB was supposed to be a check but now even that’s being neutered by SCOTUS rulings that favor capital over cure. we are literally paying for the privilege of being denied life-saving drugs because someone’s lawyer wrote a better brief than a scientist wrote a patent claim

Ada Maklagina

December 13, 2025 AT 10:10the orange book is a mess but at least they’re finally trying to fix it. hope the perjury rule sticks.

Harry Nguyen

December 13, 2025 AT 22:42you want cheaper drugs? stop letting foreigners make them. if we made insulin in america, we wouldn’t need all this legal nonsense. this is what happens when you outsource everything and then cry about the bill.

Kylee Gregory

December 14, 2025 AT 17:43there’s a middle ground here. not every patent is junk, and not every lawsuit is evil. but the system’s tilted so far that even good-faith actors get dragged into the mud. maybe we need a third-party review board-neutral, fast, cheap-to screen patents before they get listed. not more lawsuits. more sanity.

aditya dixit

December 15, 2025 AT 15:05the real tragedy isn’t the lawsuits-it’s that we’ve normalized this. we accept that a cancer drug should cost $300 because a lawyer filed a patent on the pill’s color. we don’t riot. we just pay. and then we scroll past another ad for Ozempic like it’s just another snack. we’ve turned healthcare into a spectator sport where the players are corporations and the fans are dying.

Stephanie Fiero

December 15, 2025 AT 16:41imagine if we spent half as much on drug research as we do on patent lawyers. we’d have cures for alzheimers by now. also typo: its not 'junk patents' its 'junk legal tactics' but u get the point lol

Carole Nkosi

December 16, 2025 AT 02:00in south africa we wait years for generics even when patents expire. this isn't just an american problem. it's global exploitation dressed up as law. the same companies that block access here sell the same drugs cheaper in europe. hypocrisy has a patent number.

Stephanie Bodde

December 16, 2025 AT 09:10thank you for writing this. i have type 2 and i’ve watched my insulin price triple in 5 years. this isn’t just policy-it’s personal. 🙏

an mo

December 16, 2025 AT 21:02the IPR surge is a tactical response to patent thickets, but the Smith & Nephew ruling creates a chilling effect on market entry by restricting standing. the regulatory arbitrage between FDA and USPTO is now a structural flaw in the innovation ecosystem. the 47% YoY increase in IPRs reflects systemic pressure, not progress.

Chris Brown

December 17, 2025 AT 00:14the fact that we allow companies to extend monopolies through packaging patents proves we have no moral compass left in healthcare. this isn’t capitalism. it’s legalized theft dressed in a suit. and the people who profit? they don’t even care. they’re too busy counting their quarterly dividends to notice the bodies piling up.