When you pick up a prescription for generic lisinopril or metformin, you might assume the price is set by the market - low because lots of companies make it. But that’s not the whole story. The truth is, government control of generic prices shapes what you pay at the pharmacy, even if it’s not obvious. Unlike brand-name drugs, where companies set prices based on patents and demand, generic drugs are caught in a web of federal rules, rebate systems, and hidden middlemen. Understanding how this works helps explain why your $5 generic one month jumps to $45 the next - and why some people pay nothing at all.

How Medicaid Forces Drug Companies to Lower Prices

The biggest lever the U.S. government uses to control generic drug prices isn’t direct price-setting - it’s rebates. Under the Medicaid Drug Rebate Program (MDRP), companies that want to sell drugs to Medicaid must agree to pay back a portion of what they charge. For generics, that rebate is either 23.1% of the Average Manufacturer Price (AMP) or the difference between AMP and the lowest price they offer any commercial buyer - whichever is higher. This rule, in place since 1990, means manufacturers can’t charge Medicaid more than they charge anyone else without paying the difference back. In 2024, these rebates totaled $14.3 billion, and 78% of that came from generic drugs. That’s not a tax - it’s a condition of doing business with Medicaid, which covers over 80 million Americans. The program doesn’t cap prices, but it makes it unprofitable to overcharge. If a company tries to jack up the price for private buyers to boost profits, they end up owing more to Medicaid. That’s why most generic manufacturers keep prices low across the board.Medicare Part D and the $2,000 Cap

For seniors on Medicare Part D, generic drug costs used to climb with no limit. But that changed in 2025. The Inflation Reduction Act (IRA) capped out-of-pocket spending for Medicare beneficiaries at $2,000 per year - a massive shift. Before this, people on multiple generics could easily hit $5,000 or more in annual costs. Now, once they hit $2,000, the government covers nearly all remaining drug expenses for the rest of the year. This rule especially helps low-income seniors. Those enrolled in the Low-Income Subsidy (LIS) program pay between $0 and $4.90 per generic prescription. For brand-name drugs, that number is $0 to $12.15. The IRA didn’t just cap spending - it changed how coinsurance works. Now, during the initial coverage phase, beneficiaries pay 25% of the generic drug cost, not the full price. That’s because the plan pays the rest, and the manufacturer pays a rebate back to the plan. It’s a three-way system: you pay a little, the plan pays a lot, and the drugmaker pays the difference.The 340B Program: Hidden Discounts for the Poorest Patients

Most people don’t know about the 340B Drug Pricing Program, but it’s one of the most effective tools for lowering generic drug costs. Hospitals and clinics that serve low-income, uninsured, or rural patients - like community health centers - get drugs at steep discounts, often 20% to 50% below the Average Manufacturer Price. These discounts apply to both brand-name and generic drugs, but generics benefit the most because they’re already cheap. A 2025 survey by the Community Health Center Association found that 87% of these clinics reported better patient adherence because of 340B. One patient in Ohio went from skipping her generic statin because it cost $60 a month to taking it daily after her clinic switched to a 340B supplier. The program doesn’t set prices for the public market, but it forces manufacturers to offer lower prices to safety-net providers - which indirectly pressures the whole system.

Why Some Generic Prices Spike - And Who’s to Blame

Not all generics are created equal. When only one or two companies make a drug, prices can explode. Take pyrimethamine (Daraprim), used to treat rare parasitic infections. In 2024, when only two manufacturers remained, the price jumped 300%. Why? No competition. No one to undercut them. The government doesn’t step in to set a price cap - so the market fails. This happens most often with older, low-margin drugs that aren’t profitable enough to attract many makers. The FDA approves hundreds of generics every year, but many are for popular drugs like antibiotics or blood pressure meds - where dozens of companies compete. For obscure drugs, the market is thin. The Department of Health and Human Services has studied “Most-Favored-Nation” pricing - tying U.S. prices to what other countries pay - but so far, it’s only been proposed, not enacted.Pharmacy Benefit Managers: The Hidden Middlemen

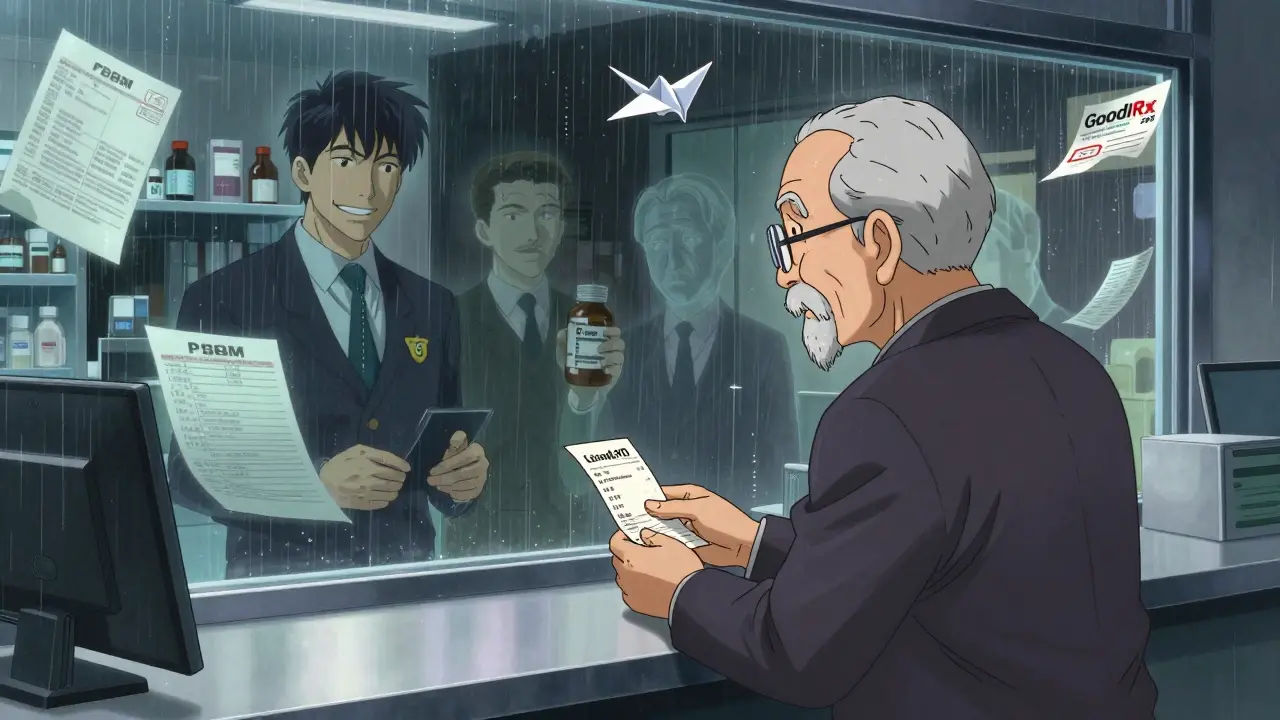

You might think your insurance company negotiates your drug prices. But in reality, it’s often a Pharmacy Benefit Manager (PBM) - a middleman hired by insurers or employers. PBMs collect rebates from drugmakers, but they don’t always pass them on to you. A July 2025 Senate report found that 68% of the “savings” from generic drug rebates never reach the patient. Instead, PBMs keep them as profit or use them to lower premiums for the insurer - leaving you stuck with high copays. This is why two people on the same insurance plan can pay wildly different amounts for the same generic. One’s plan uses a PBM that passes on rebates; the other’s doesn’t. It’s opaque, confusing, and unfair. That’s why consumer groups are pushing for transparency laws - requiring PBMs to disclose exactly how much they’re charging and how much they’re keeping.How the U.S. Compares to Other Countries

The U.S. is an outlier. Most wealthy countries - Canada, Germany, the UK - directly negotiate or set drug prices. The UK’s NICE agency evaluates whether a drug is worth its cost. Germany uses a similar system. In both, generic prices are controlled from the top down. In the U.S., we rely on competition. And it works - for some drugs. The average generic is 80-85% cheaper than its brand-name version. But according to a 2025 KFF analysis, U.S. generic prices are still 1.3 times higher than the average of 32 other OECD countries. Why? Because we have no central buyer. In Canada, the government buys for the whole country. In the U.S., Medicare, Medicaid, private insurers, and 340B clinics all negotiate separately. That fragmentation weakens bargaining power. Still, we win in speed. Once a patent expires, 90% of U.S. prescriptions are filled with generics - compared to 65% in Europe. That’s because our FDA approves generics faster, and manufacturers rush in to compete. But speed doesn’t mean fairness.

Who’s Winning and Who’s Losing

The system favors big players. Teva, Mylan, and Sandoz control nearly 40% of the generic market. They have the resources to navigate complex rebate rules and FDA approvals. Smaller manufacturers? They struggle. Many operate on profit margins under 15%. Some have shut down entirely when prices dropped too low. Patients on fixed incomes are caught in the middle. A 2025 KFF survey found that 18% of Americans said generic drug costs made them skip doses. One woman in Florida paid $15 a month for her generic lisinopril - until her pharmacy switched to a different manufacturer with a higher copay. She got a $90 bill. No warning. No explanation. Just a different pill with a higher price tag. Meanwhile, the government is quietly expanding its reach. In 2027, Medicare will start negotiating prices for generic versions of popular drugs like apixaban and rivaroxaban. These are high-volume, high-cost generics - and the government hopes to cut prices by 25-35%. If it works, it could become a model for more.What’s Next for Generic Drug Prices

The future of generic pricing isn’t about banning profits - it’s about fixing broken incentives. Experts agree on a few things: we need more competition, better transparency, and smarter rules for drugs with few makers. The Academy of Managed Care Pharmacy says eliminate barriers to entry - make it easier for new companies to enter the market. Dr. Peter Bach argues Medicare should negotiate like the VA, which gets 40-60% discounts through bulk buying. The Congressional Budget Office estimates that expanding Medicare negotiation to include select generics could save $12.7 billion over ten years. That sounds small compared to the $400 billion U.S. spends on drugs annually - but for the people who rely on these medications, it’s life-changing. What’s clear is this: the current system isn’t broken - it’s working as designed. But the design was meant for a different era. Today, with more seniors on multiple generics and more drugs going off-patent, we need a system that doesn’t just rely on luck and competition. We need rules that ensure no one pays $90 for a pill that should cost $15.Why are generic drug prices so unpredictable?

Generic prices jump when competition drops. If only one or two companies make a drug, they can raise prices without fear of losing customers. This often happens with older, low-profit medications. Even small changes - like a pharmacy switching to a different manufacturer - can cause your copay to spike. There’s no law requiring price stability, so it’s up to market forces, which don’t always protect patients.

Does the government set the price of generic drugs?

No, the federal government doesn’t directly set prices for generic drugs in the commercial market. Instead, it uses indirect tools: Medicaid rebates, the 340B discount program, and now Medicare negotiation for select high-cost generics. These mechanisms pressure manufacturers to lower prices without the government stepping in to say, "This pill costs $5." The Inflation Reduction Act changed this in 2026 by allowing Medicare to negotiate prices for certain high-expenditure drugs - including some generics - but only those with little competition and high spending.

Why do I pay more for the same generic drug at different pharmacies?

Because your insurance plan and the pharmacy’s contract with your Pharmacy Benefit Manager (PBM) determine your price - not the drug itself. Two pharmacies might stock the exact same generic, but one has a better rebate deal with your PBM, so your copay is lower. Also, some pharmacies offer cash discounts that aren’t tied to insurance. Always ask: "What’s your cash price?" It might be cheaper than your insurance copay.

How does the Medicaid Drug Rebate Program affect me if I’m not on Medicaid?

Even if you’re not on Medicaid, the program keeps generic prices lower for everyone. Manufacturers must offer their lowest price (called the "best price") to Medicaid - and that same price becomes the baseline for private insurers and PBMs. If a company tries to charge more to private buyers, they owe Medicaid the difference. So Medicaid’s rebate rules indirectly cap prices across the board.

Can I get generic drugs cheaper through Medicare Part D?

Yes - especially if you qualify for the Low-Income Subsidy (LIS). LIS beneficiaries pay $0 to $4.90 per generic prescription. Even without LIS, the $2,000 out-of-pocket cap introduced in 2025 means once you hit that limit, your generic drugs cost almost nothing for the rest of the year. Many Part D plans also offer $0 premium options for generic-only coverage. Use the Medicare Plan Finder tool to compare plans - it’s free and updated monthly.

What You Can Do Today

If you’re paying too much for generics, here’s what actually works:- Ask your pharmacist for the cash price - sometimes it’s lower than your insurance copay.

- Use GoodRx or SingleCare to compare prices across nearby pharmacies.

- If you’re on Medicare, check if you qualify for LIS - it can cut your costs by 80%.

- Switch to a different Part D plan during open enrollment if your generic isn’t covered well.

- Call your state’s Health Insurance Assistance Program (SHIP) - they help people navigate drug costs for free.